Outside Is Expensive: Budgeting for a Post-Pandemic World

Kara Pérez is the founder of Bravely Go, a financial platform focused on feminist economics and inclusive personal finance

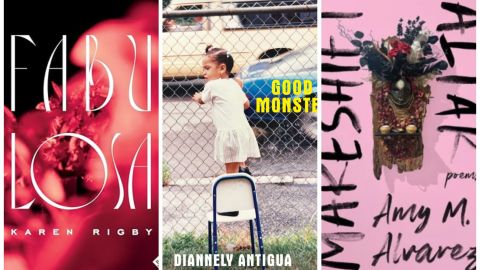

Photo: Instagram/@webravelygo

Kara Pérez is the founder of Bravely Go, a financial platform focused on feminist economics and inclusive personal finance.

You’re waxed and vaxxed and ready to get back outside after quarantining for almost all of 2020. But wait: Lyft’s are HOW MUCH now? And you want me to pay WHAT for brunch? I literally forgot that outside costs money. You need a hot girl summer, but you also need to not go broke. And that’s where budgeting (yes, I said it!) comes into play.

Por Qué Budgeting?

Budgeting is life y’all, I will die on this hill. People think that budgeting is a lack of freedom but that is just budget slander! Budgeting is a plan for your money. And if you want to have the hot girl summer you so richly deserve, you’re going to need a plan.

The first thing you need to do is simply review your current financial picture. And that’s something you should do without judgement, shame, or self hatred. I promise that you can’t hate yourself into being better with money long term, and anyway, self hatred is NOT a part of Hot Girl Summer.

Budgeting in Two Steps

- Log in to your bank account and look up your debit card spending. Log in to your credit card and do the same. Export the information to a spreadsheet and organize it into categories like groceries, transport, bills, and rent. Add them up to get the total you’re spending monthly.

- Next, add lines to the spreadsheet for your savings and investments, and then another line for any debts you have like student loans or credit cards.

- Now you have a picture of your money! And it is upon this foundation that you’ll build your new budget.

Remember: check that judgement at the door. This spreadsheet is going to guide you to hot girl summer and shame has no place here. Past decisions are behind us; we’re going to move forward with power and self love.

wp_*posts

How to Actually Use Your Budget

Budgeting works best when you combine planning and consistency.

If you’ve got consistent income each month budgeting is even easier. You know you get $2,000 every two weeks, so you can create a budget for each paycheck.

That might look like this:

$1000 – rent

$140 – utilities

$200 – savings

$250 – food

$200 – student loans

$80 – gas

$100- going out

Total: $1970 for the first two weeks of the month.

When you get your next paycheck, you allocate the money to remaining expenses and goals!

For bigger expenses, plan as far in advance as you can. Meaning, if you know that you want to spend Labor Day weekend away with your best friends, you can start saving money for that now.

Budgeting is how you keep everything organized. At the start of each week, for example, sit down and make a plan for going out that week. Look at what you’ve allocated for each expense and make plans around those numbers.

Dinner out with boo: $40 on Friday

Shopping with Mami: $100 on Saturday

Brunch with Yessica: $30 on Sunday

You need $170 for the weekend. Using our above budget, you’ve got $100 to go out and $250 for food. Knowing these weekend plans on Monday allows you to do things like eat dinner at home during the week so you can afford to go out during the weekend and NOT go into debt.

What if You Don’t Have a Lot of Money?

Join the club! Most Americans don’t earn very much money, and we know there is a race and gender pay gap that many of us are dealing with as well.

For lower income folks, I think the most important money skill to quickly master is talking honestly with friends and family about their financial limits.

If you have a bougie friend who doesn’t know that you don’t have a lot of spare cash, you might feel resentful of them for always picking expensive places to hang.

Practice bringing the conversation up with phrases like these:

“I’d love to go to that place, but I’m really working on paying down some debt right now. Can we try X place instead?”

“I absolutely love hanging out with you, but there are some things I can’t do this year while I’m getting my money right. I can do things like X, Y and Z instead.”

This is a great way to express how much you love someone but how you also need to be realistic about your financial situation. You don’t have to show someone your bank account to practice financial transparency!

wp_*posts

Easy Ways to Save And Still Have Fun

A common piece of advice in the personal finance world is to cut back on the small expenses to save money. Coffee and avocado toast have been painted as villains and the reason that so many people struggle with money. At its core, that advice is classist and tone deaf.

It’s not the $3 coffee that makes it hard to retire, it’s the fact that 41 percent of Millennials don’t have access to a 401k. Personal decisions absolutely impact your money, but they’re made within larger flawed systems that have a much bigger impact.

One of the best ways to save money is actually to focus on the largest expenses in your life: housing, food, and transportation. If you can find a way to lower your rent by $200 a month, you’ll save more than by cutting out a three times a week $3 coffee.

Here are tips to handle the larger, more expensive costs in your life:

Always negotiate everything!

You absolutely can negotiate rent. Try asking for a 15% discount if you can pay the first 3 months upfront when signing a new lease.

Invest in the shared economy.

Do you need a car of your own if your partner has one you can share and you live in a city with easy rideshare access or public transport? Maybe you can give up your car and take the bus to work once a week and carpool with a coworker the rest of the week. Now instead of gas, a car payment, and car insurance, you just have to pay for a bus pass and give some gas money to your coworker.